RealPage Investment Management

Gain reliable insights and portfolio-wide visibility for more informed investment decisions, a streamlined capital-raising process, and enhanced investor interactions.

Make Investment Decisions with Confidence

Get your data house in order for more confident decision-making with RealPage Investment Management, including a data-driven solutions suite and services that enable trustworthy insights, portfolio-wide visibility, and enhanced investor interactions.

Trusted Data Set

Access Dependable Data

To make sound investment decisions, you need a comprehensive, reliable data set. RealPage Investment Management solutions suite gives you a single source of truth across your financial, operational, and ESG data while streamlining data collection with AI/ML-driven ingestion solutions. Our automated validation engine ensures accuracy, and managed data collection services keep you focused on your core business.

- Asset Investment Management (AIM)

- Data Collection Services (DCS)

Portfolio-wide Visibility

Gain Holistic Insights

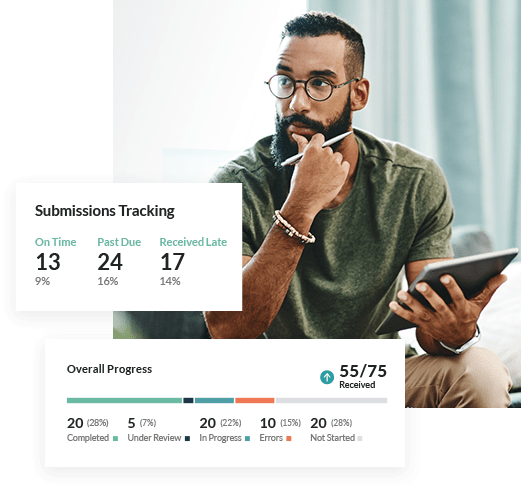

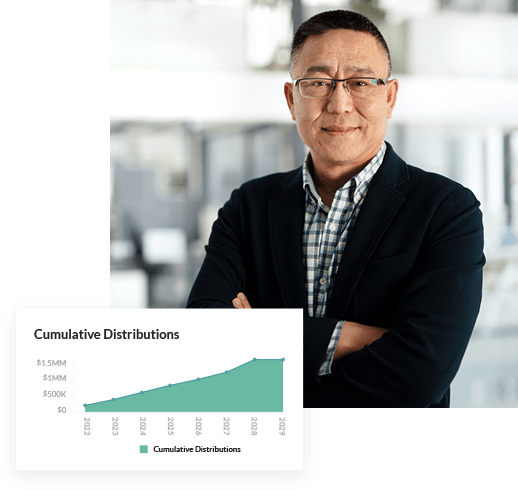

Get visibility into all asset types across the portfolio and investment lifecycle. Optimize performance and returns and manage risk more effectively with self-service access to intelligent dynamic visualizations—including robust dashboards, KPIs, and metrics—as well as automated valuation and modeling. With the ability to scale across asset types and strategies, RealPage provides a future-proof solution that grows with you.

Enhanced Investor Interactions

Deliver Modernized Experiences

Develop stronger investment relationships with streamlined processes and engaging interactions. Get faster funding, reduce the cost of acquiring capital, and increase client retention by enhancing investor transparency and engagement. Modernize the investment experience through streamlined reporting and investor communication and a dedicated, secure self-service investment portal.

Solutions for Every Stage of the Investment Lifecycle

RealPage Investment Management is an end-to-end suite of front-office, data-driven software solutions that incorporates investor management and reporting, asset and portfolio management, financial modeling, investment accounting, market data and benchmarking, and managed data collection services.

Investment Accounting

Asset & Investment Management

Business Intelligence & Market Data

Investor Management & Reporting

Financial Modeling

Data Collection Service

Investment Lifecycle

“As a multi-asset class investment firm, RealPage’s AIM product has delivered solutions that can’t be found elsewhere. From commercial space to multifamily to hotels and more, having a single platform where performance and financial data can be compiled automatically and analyzed was the difference maker. Other software providers often won’t integrate the with 3rd party property management systems and RealPage AIM is up for the task. I would recommend this solution to other firms who have assets managed by different property managers or assets in different classes.”

Core Investment Management Suite

Scalable Solutions for Unlimited Opportunity

Asset Investment Management (AIM)

Data Collection Services (DCS)

Investment Accounting

Investor Management Services (IMS)

FUEL

Finding the Right Fit Starts Here

Real Estate Fund/Portfolio Manager

Identify insights and opportunities to fund investment strategies, drive ROI and support a growing investor base

Real Estate Asset Manager

Improve performance insights, visibility and business intelligence to maximize asset portfolio value and returns

Real Estate Investment Firms/Syndicators

Increase revenue visibility and operational insights to optimize multifamily asset performance and value

IM Essentials

Get all the critical tools and transparency to keep your investors engaged, find opportunities to increase NOI, and plan for the future at every stage of your asset and portfolio lifecycle — with the industry’s most comprehensive and cost-effective front-office solution for growth-focused real estate owners and firms:

- Accelerate capital raises

- Monitor & model portfolio performance

- Identify risk & trends

- Make informed decisions

- Improve efficiency

- Maximize value for investors

Peak Performance Platform Options

Enhance Your Existing Systems*

Saving hundreds of hours annually in manual data collection, normalization and analysis is easier and more effective when you can securely integrate your investment management solution with the major property management and accounting systems you are already using.

*RealPage’s reference to the foregoing third-party trade names and trademarks is for informational purposes only, to illustrate that Investment Management is compatible with these systems. Such reference is not intended to and does not imply any affiliation with, or endorsement by or of, such third parties.

Build Trust and Transparency

Provide performance transparency for your stakeholders quickly and easily. Create personalized reporting and collaborate directly on insights with the Investment Management platform.

Focus On What Matters

Leverage our Managed Services team to handle the complexities of data administration and advanced security, integration, standardization and governance — so you can focus on what you do best.

Right Data, Right Insights, Right Now

Understand the drivers of investment performance, pinpoint the casual factors affecting your returns and accelerate reporting and communication with automated data gathering, real-time analysis and role-based, self-service dashboards.